US-China trade deal pause: What it means for the economy

Anúncios

The US-China trade deal pause leads to economic uncertainty, affecting consumer prices, job security, and international relations, while negotiations may focus on tariff reductions and intellectual property rights.

The US-China trade deal pause has many people wondering about its implications. What does this mean for the economy, and how might it affect your daily life? Let’s dive into the details.

Anúncios

Overview of the US-China trade relations

The US-China trade relationship is complex and vital to the global economy.

This relationship has evolved over decades, affecting trade policies, tariffs, and economic growth in both countries.

Historical context

Historically, the US and China have had significant trade ties. As China transitioned to a market economy, exports to the US soared. This growth resulted in major economic shifts and increased interdependence.

Current trade dynamics

Today, the trade relationship is influenced by several factors:

Anúncios

- Tariffs: Tariffs have been a major tool in trade negotiations, impacting prices for consumers and businesses.

- Imports and Exports: The balance of imports and exports between the two nations is crucial for economic stability.

- Supply Chains: Many industries rely on a global supply chain that includes both China and the US.

In recent years, tensions have increased, leading to changes in trade agreements.

The pause in the trade deal signifies uncertainty, as both nations navigate their economic futures.

Future prospects

Looking ahead, the relationship will likely continue to evolve. Businesses and consumers alike will feel the effects of any new policies or agreements.

Understanding the trade dynamics is essential for anyone interested in international markets.

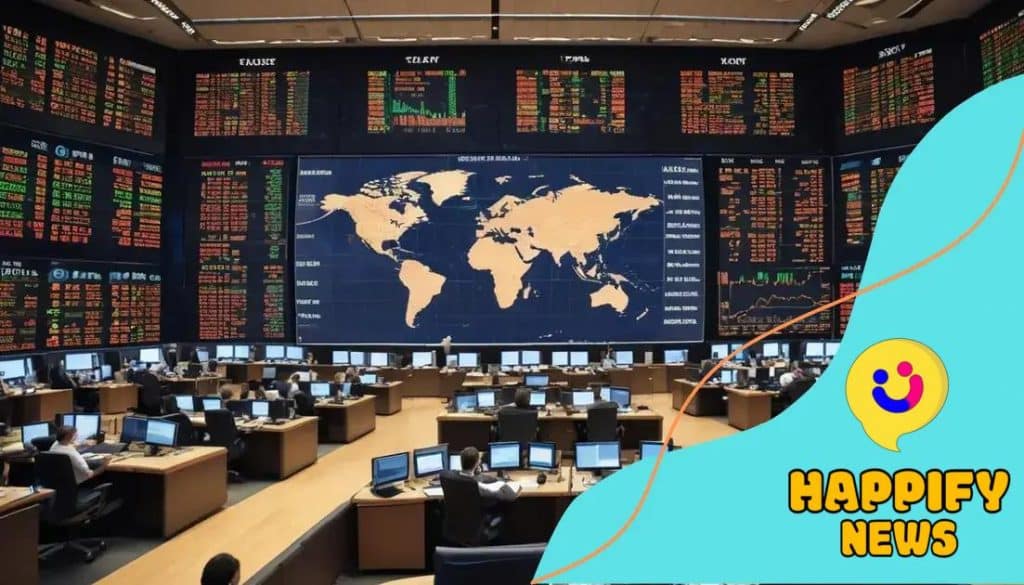

Impact of the trade deal pause on global markets

The pause in the trade deal between the US and China has sent ripples through global markets.

Investors and businesses worldwide are paying close attention to how this uncertainty may affect them.

Effects on stock markets

When news of the trade deal pause broke, stock markets reacted swiftly. Major indices, such as the S&P 500 and Dow Jones, experienced fluctuations.

This volatility can be attributed to investor fear regarding future trade relations.

Commodity prices

Commodity prices have also been influenced by the trade deal pause. Key commodities include:

- Oil: Prices may decrease due to reduced economic activity in both countries.

- Metals: Tariffs could increase the cost of imports.

- Agricultural products: Farmers may face challenges in exports to China.

These changes affect not just producers but also consumers worldwide, as prices can fluctuate based on supply and demand.

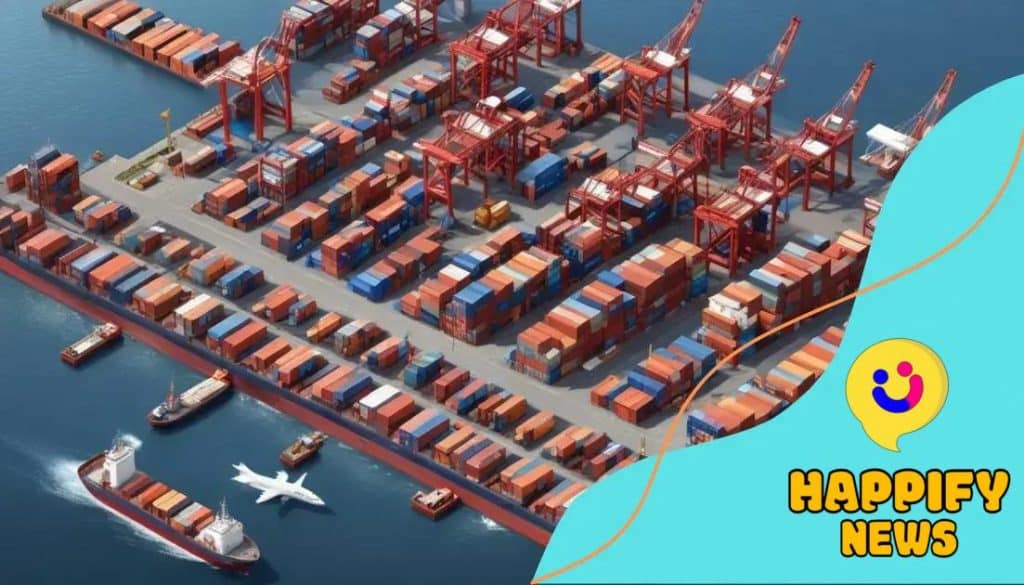

Impact on supply chains

The trade deal pause can disrupt established supply chains. Businesses that rely on imports from China may need to adjust their sourcing strategies. The uncertainty can lead to:

- Increased costs: Higher tariffs often result in increased prices for consumers.

- Delays: Supply chain disruptions can result in longer lead times for products.

- Market adaptation: Companies may seek to diversify their suppliers to mitigate risks.

Understanding these impacts is crucial for businesses and investors alike as they navigate the changing landscape. As the situation evolves, the response from global markets remains to be seen.

Key industries affected by the trade deal pause

The trade deal pause impacts various industries significantly. Understanding which sectors are affected helps businesses and consumers prepare for changes.

Technology sector

The technology industry faces unique challenges due to its reliance on global supply chains.

Companies that depend on components manufactured in China may encounter delays and higher costs.

Notably, major tech firms are concerned about tariffs that could affect their profit margins.

Agriculture industry

Farmers and agricultural businesses are feeling the pinch as the trade deal pause complicates exports. Key issues include:

- Tariffs on exports: Products like soybeans and corn are facing increased tariffs, reducing competitiveness.

- Market access: Farmers may struggle to maintain their share in the Chinese market.

- Price volatility: Uncertainty can drive up prices and affect farmers’ revenues.

As these challenges mount, farmers must adapt to changing market conditions and find new export opportunities.

Manufacturing sector

Manufacturers are also affected by the trade deal pause. The disruptions can lead to:

- Increased production costs: Higher tariffs and shipping costs may cut into profits.

- Supply chain disruptions: Companies may need to source materials elsewhere, complicating operations.

- Job security: Uncertain conditions may lead to layoffs or hiring freezes.

Manufacturers must navigate these complexities to stay competitive while keeping an eye on potential policy changes.

Retail sector

The impact on the retail sector is evident as well. Consumers may see price increases on a wide range of products, from electronics to clothing.

Retailers must respond by adjusting pricing strategies and inventory management. Additionally, supply chain adjustments become essential to mitigate rising costs.

Overall, the trade deal pause creates a challenging environment across several key industries, pushing companies to innovate and adapt swiftly to new realities.

Potential economic consequences for the US and China

The potential economic consequences of the trade deal pause are significant for both the US and China.

As these two major economies navigate through uncertain waters, the implications can be far-reaching.

Impact on GDP

The Gross Domestic Product (GDP) of both nations may experience fluctuations. In the US, a decline in exports to China can reduce economic growth.

Conversely, China might face slower growth due to decreased US demand for its products. This scenario creates a delicate balance, as both economies are closely intertwined.

Job market effects

Job markets in both countries could also feel the strain. In the US, industries reliant on exports may face layoffs or hiring freezes.

Farmers and manufacturers are particularly vulnerable, as they adapt to changing demand. In China, the potential drop in orders could lead to similar job losses, affecting millions.

Inflationary pressures

Inflation is another concern resulting from the trade deal pause. Increased tariffs can lead to higher prices for consumers in both the US and China.

As costs rise, purchasing power may diminish, which can negatively impact consumer spending.

Long-term economic relations

The long-term effects of this pause in trade negotiations could reshape relationships between the US and China.

Trust and cooperation may diminish, leading to an unpredictable economic environment. Both nations will need to consider how to maintain trade cooperation to avoid further disruptions.

Overall, the economic consequences of the trade deal pause are complex and multifaceted, affecting trade dynamics, job security, consumer prices, and international relations between two of the world’s largest economies.

Public and political reactions to the trade uncertainty

The public and political reactions to the trade uncertainty are essential to understand how the situation is being perceived in both the US and China.

As the trade deal pause unfolds, various stakeholders express their opinions and concerns.

Public sentiment

Public sentiment regarding the trade deal pause is mixed. Many consumers are worried about the rising prices of goods and potential job losses.

For instance, farmers express anxiety as they rely heavily on exports to China. On the other hand, some consumers believe that the pause could lead to a better deal in the long run.

Political responses in the US

In the US, political leaders are reacting to the pause with a focus on maintaining economic stability. Several points are frequently raised:

- Concern for jobs: Many politicians emphasize protecting American jobs that depend on trade.

- Negotiation approach: There are calls for a more strategic approach to negotiations, encouraging compromise.

- Bipartisan support: Some leaders advocate for a united front to strengthen the position in negotiations.

These reactions reflect a desire to safeguard both the economy and workers’ interests during the uncertainty.

Political responses in China

In China, government officials express hope for a resolution but stress the need for defending national interests. Public statements often focus on:

- Stability of trade relations: Emphasis on maintaining stable trade relationships is critical.

- Domestic support: Leaders encourage domestic consumption to buffer any negative impacts.

- Calls for dialogue: Officials advocate for open dialogue to resolve misunderstandings.

As both nations navigate these uncertain times, the public and political reactions play a crucial role in shaping future trade policies.

The interplay between public opinions and political responses can ultimately influence negotiations and economic outcomes.

Future outlook for US-China trade negotiations

The future outlook for US-China trade negotiations remains uncertain but filled with potential. As both nations grapple with ongoing challenges, the landscape of international trade could change dramatically.

Factors influencing negotiations

Several factors are likely to shape the direction of future trade talks:

- Economic performance: The economic situation in both countries will significantly influence how negotiators approach discussions.

- Political climate: Changes in political leadership or public sentiment can impact negotiating strategies.

- Global relations: The status of trade relations with other countries may also play a role in shaping US-China negotiations.

As these elements evolve, they will likely affect the willingness of both sides to compromise.

Potential areas of agreement

Despite challenges, there are areas where both countries might find common ground. These could include:

- Tariff reductions: Both sides may be open to discussing ways to lower tariffs, promoting smoother trading.

- Intellectual property rights: Addressing concerns over intellectual property could be a key issue on the table.

- Supply chain resilience: Collaborating to enhance supply chain stability might be a mutually beneficial goal.

The ability to reach agreements in these areas could help bridge gaps in negotiations.

Long-term implications

Long-term implications of these negotiations will affect not just the US and China but also the global economy.

As trade relations evolve, companies and consumers could experience significant changes in prices and product availability.

Additionally, ongoing uncertainty may prompt businesses to diversify their supply chains to reduce reliance on one country.

Overall, the future outlook for US-China trade negotiations is complex, with potential for both cooperation and conflict. Stakeholders from both nations will need to stay informed and adaptable as the situation changes.

The ongoing trade dynamics between the US and China present a complex web of challenges and opportunities.

With the trade deal pause impacting various sectors, it is crucial to monitor how economic factors, public sentiment, and political responses shape future negotiations.

As both countries navigate this uncertain landscape, the potential for both cooperation and conflict remains high.

Companies and consumers alike must remain adaptable, ready to respond to changes that could affect prices and product availability.

Ultimately, the outcome of these negotiations will have lasting implications for global trade relations.

FAQ – Questions about the US-China Trade Deal Pause

What are the main concerns regarding the US-China trade deal pause?

The main concerns include rising prices for consumers, potential job losses, and economic instability affecting both nations.

How might the trade deal pause affect everyday consumers?

Consumers may see increased prices on a variety of goods and potential shortages as supply chains face disruptions.

What areas might both countries agree on in future negotiations?

Future negotiations may focus on tariff reductions, improved intellectual property protections, and enhancing supply chain resilience.

How do public and political reactions influence trade negotiations?

Public opinion and political pressure can shape negotiation strategies, encouraging leaders to prioritize economic stability and job protection.